Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

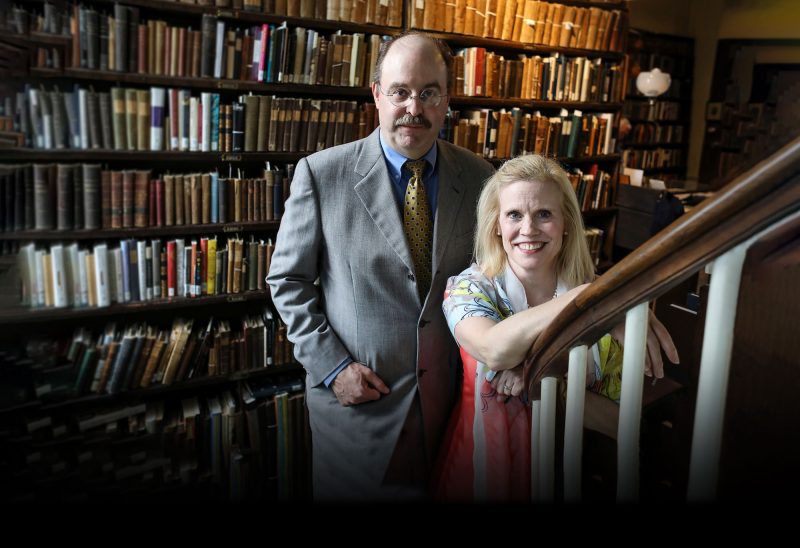

Sarah Ambrogi is an estate planning attorney at Ambrogi Law Office in Manchester and past co-chair of the Trust and Estate section of the New Hampshire Bar Association and a member of the New Hampshire Women’s Bar Association. She serves as a director for the New Hampshire Estate Planning Council.

Ambrogi said asking her clients about charity is fundamental.

“I was raised in a family where philanthropy was just a given — it was very much a part of what you did,” Ambrogi said. “Giving to your church, to local arts organizations…it was just a given. I have an assumption that people have a tendency to want to be philanthropic, and I carry that with me. I very rarely have somebody say ‘I have no interest in charity.’ Most people have some interest.”

Talking about charitable intent is part of building relationships with her clients — and building relationships helps to focus those conversations.

“It’s really important to get to know your clients, because as you get to know them the sources of their passions and interests are going to come out…and you are going to be a much better planner if you have taken the time to really get to know them.” She also makes sure people have the right team in place to help advise them — including a financial advisor. Many people, she said, do not realize they can use a variety of assets — like IRA distributions or non-cash assets — to give to charity.

I have an assumption that people have a tendency to want to be philanthropic.

– Estate planning attorney Sarah AmbrogiTweet This

For Ambrogi, the conversation about philanthropy is never a one-way street. She often talks about her own experiences with charitable giving as part of that larger conversation. “I may say ‘you’re really interested in the arts…my husband and I have also been thinking about that recently.’ I try to lead by example, but without hitting people over the head.”

She encourages people to think about philanthropy in conjunction with their wider plan — not as an afterthought.

“People want to make sure they provide for their families, and think about charity being something to put in place if their family didn’t survive them,” she said. But she suggests that both things can be considered simultaneously — and is willing to share her own family’s plan: “My husband and I recently updated our estate plan and set aside percentages for four charitable entities we are interested in. We set aside ten percent off the top for those four…it seems to me my kids will be okay with 90 percent.”

In the course of her practice, she has seen the difference that charity can make — not just to the people and organizations on the receiving end, but to the folks doing the giving.

One of her clients, with whom she had worked closely, had willed his estate to Médecins Sans Frontières (Doctors Without Borders) because he wanted to help children who had been the victims of war and natural disasters.

As he neared the end of his life, he would check in with her: “You’ve got it all set up, it’s all going to help kids?” She assured him she did — and that knowledge brought him peace.

“He felt really proud that he was doing something meaningful and helping kids,” she said.

Ambrogi’s nutshell advice for having the philanthropic conversation:

“First of all, you’ve got to ask the question,” she said. “Even if it’s a short little question on a questionnaire. You’ve got to make sure the right partnerships for teamwork are there… if they don’t have a financial advisor, getting them a competent financial advisor. Make sure the team players are all there and being creative and thinking about different ways that you can suggest crafting a gift. And then knowing when it’s time to stop and say ‘the next time we see each other we can revisit it.’ But you’ve got to ask.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)