Research shows that people want their professional advisors to ask them about charitable giving. And sooner rather than later.

The 2013 “U.S. Trust Study of the Philanthropic Conversation,” conducted in partnership with The Philanthropic Initiative, showed that virtually all high-net-worth people think this discussion should happen within the first several meetings with an advisor. A third think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh it?

As part of an ongoing series, we’re asking some of New Hampshire’s most well-respected professional advisors how they “pop the question” about charitable giving.

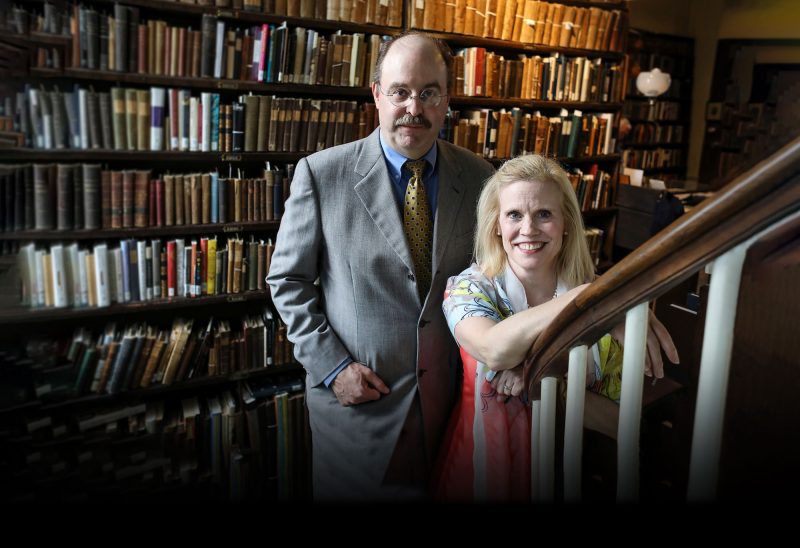

Elise Salek is an attorney who chairs the Sulloway & Hollis Tax, Trusts and Estates Practice Group in Concord. Salek is named in Best Lawyers in America in the field of Trusts and Estates, Tax Law and Trust and Estate Litigation. She specializes in estate planning and probate administration with an emphasis on federal estate and gift taxation, charitable planning, and probate litigation. She also serves on the Charitable Foundation’s Capital Region advisory board.

Salek said that she didn’t learn how to have the conversation about charitable giving during her training in law school. “And that’s part of the problem,” she said. “If you’re not comfortable talking about it, you don’t.”

She learned by observing on the job. “I learned the most from colleagues who were willing to take me under their wing and show me how they do things,” she said. Colleagues who work for smaller firms, she said, often miss out on that opportunity.

Questions about charitable giving are included her firm’s estate questionnaire.

“I had the benefit of being trained by Charlie Sheridan and Dave Conley. They were always straightforward with clients. They assumed that every client who came through the door had some sort of charitable objectives and so it was never a big deal for them to come out and ask ‘what are your favorite charities?’ It’s something that I think every estate planner has to ask.”

Wouldn’t you feel a little disappointed if someone had not bothered to ask you? I think so.

– Elise Salek, Sulloway & HollisTweet This

And the conversation continued from there. “If the estate planning questionnaire or the client’s tax return showed that someone had made a lot of charitable donations,” Salek said, that prompted the question: “Do you plan to leave anything to your favorite charities as part of your estate plan?”

To Salek, the whole process is about getting to know people.

“When your clients come in to speak to you about their estate plan, you’re not just talking about their estate plan. You’re getting to know them,” she said. And part of getting to know them is learning about what organizations and institutions they are involved with, and what causes they are passionate about. Do they support their church, arts organizations, their local food pantry or their alma mater? Are they active as volunteers? Do they serve on boards?

“Then it’s just natural to ask the next question: ‘If you love these organizations so much now, what do you plan on doing for them after you’re gone?’ And the minute you ask, they respond.”

She understands that, sometimes, advisors are not comfortable asking the questions. But she counsels pushing past that discomfort. “As an estate planner, you have to ask uncomfortable questions,” she said. “The whole process of planning for your mortality is not comfortable. I have very lengthy conversations with clients as part of the estate planning process.”

Many of her clients have donor-advised funds and engage their kids in their giving decisions, teaching philanthropy in a hands-on way. So she also asks: “what are your kids’ favorite charities?”

Salek is familiar with the data that show that people want to be asked about charitable giving.

“And so that’s another reason not to be uncomfortable,” she said. “If clients are anticipating questions about their charitable objectives, wouldn’t they be a little frustrated if they didn’t hear that question coming from their advisor? Wouldn’t you feel a little disappointed if someone had not bothered to ask you? I think so.”

The New Hampshire Charitable Foundation works with wealth managers and financial advisors, attorneys and accountants to craft customized, flexible giving strategies for their clients — helping generous people fulfill their philanthropic goals while maximizing tax benefits and reducing administrative burdens. For more information, please contact Melinda Mosier, vice president of donor engagement and philanthropy services, at zryvaqn.zbfvre@aups.bet or 603-225-6641 ext. 266.

![Indrika Arnold, Senior Wealth Advisor, the Colony Group [Photo by Cheryl Senter]](https://www.nhcf.org/wp-content/uploads/2024/05/Indrika-Arnold-Hero-800x534.jpg)